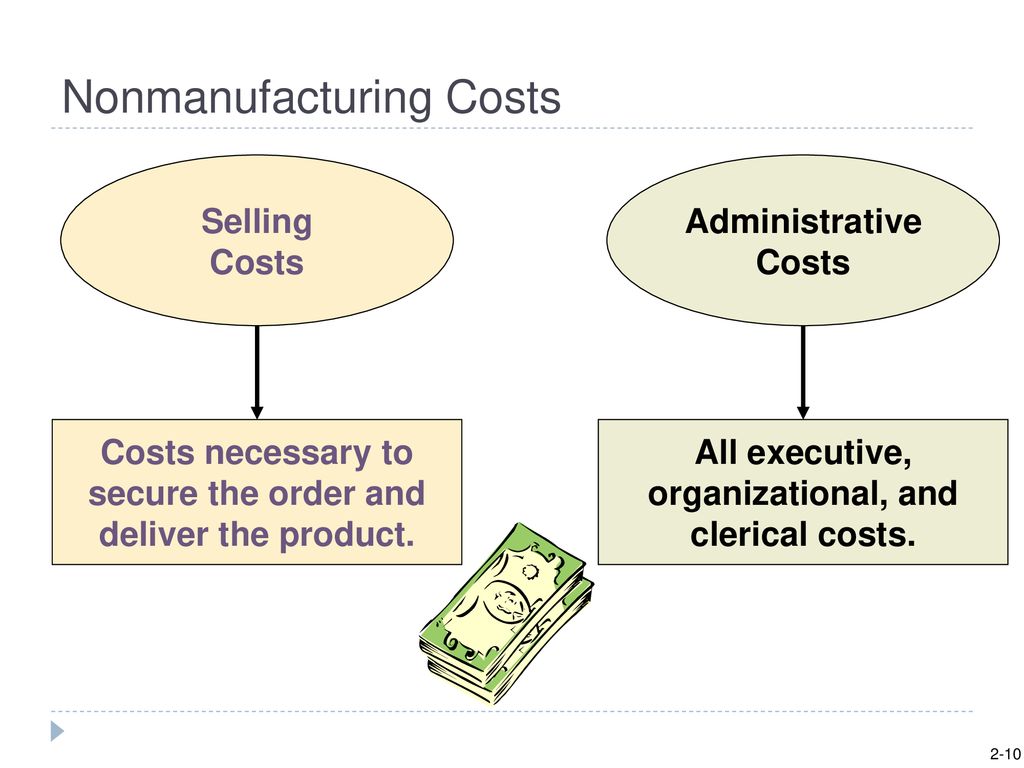

Figure 1.4 shows examples of production activities at Custom Furniture Company for each of the three categories (we continue using this company as an example in Chapter 2). For a manufacturer these are expenses outside of the manufacturing function. Instead these expenses are reported on the income statement of the period in which they occur. Non-manufacturing costs include those costs that are not incurred in the production process but are incurred for other business activities of the entity.

Example #4: Indirect manufacturing costs (factory overheads)

Sometimes it is difficult to discern between manufacturing and non-manufacturing costs. For instance, are the salaries of accountants who manage factory payrolls considered manufacturing or non-manufacturing expenses? Therefore, businesses typically establish and adhere to their own criteria. Nonmanufacturing overhead costs are the company’s selling, general and administrative (SG&A) expenses plus the company’s interest expense.

Where does the time go?

A manufacturing entity incurs a plethora of costs while running its business. While manufacturing or production costs are the core costs for a manufacturing entity, the other costs are also just as important as they too affect overall profitability. Thus, management attention must be focused on both the core and the ancillary costs to control and manage them with a view to maximize profitability on long term basis. Direct labor – cost of labor expended directly upon the materials to transform them into finished goods. Direct labor refers to salaries and wages of employees who work to convert the raw materials to finished goods. Direct materials – cost of items that form an integral part of the finished product.

Nonmanufacturing overhead costs definition

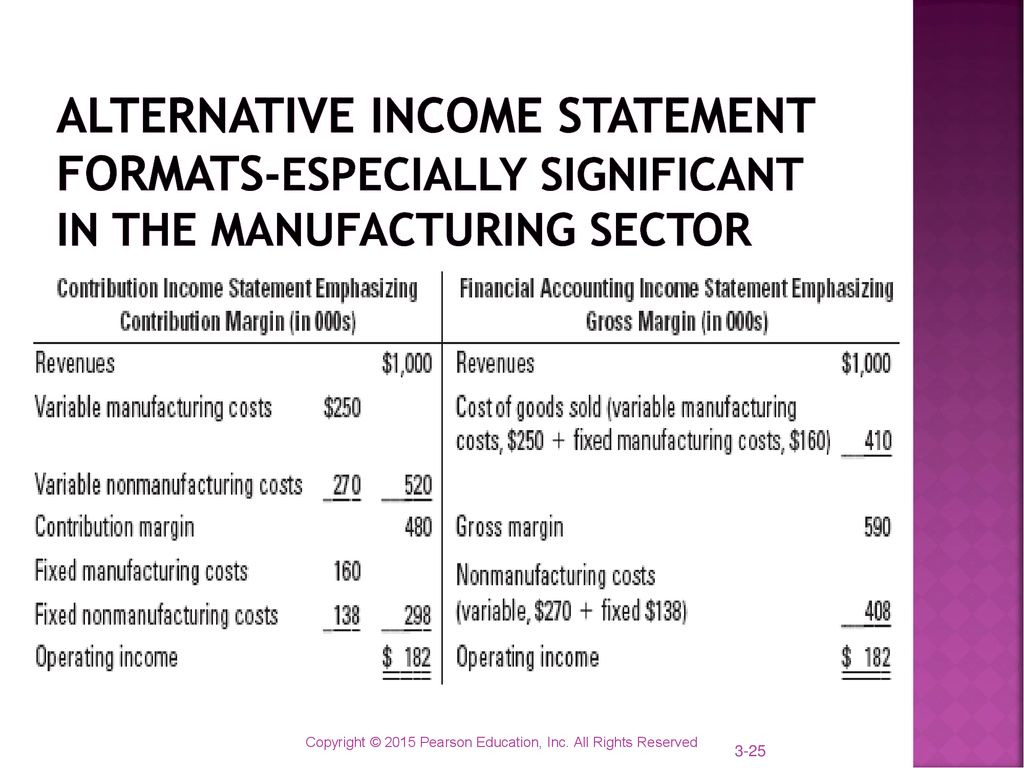

In summary, product costs (direct materials, direct labor and overhead) are not expensed until the item is sold when the product costs are recorded as cost of goods sold. Period costs are selling and administrative expenses, not related 100% free tax filing for simple returns only to creating a product, that are shown in the income statement along with cost of goods sold. Direct labor manufacturing costs is determined by calculating the cost of employees directly responsible for producing the product.

Material costs are the costs of raw materials used in manufacturing the product. By calculating manufacturing costs, manufacturers can better understand the elements that are driving up costs while identifying the most economical way to manufacture a product. Now, add the value of existing inventory to the cost of purchasing new inventory to calculate the cost of direct materials. Start by making a list of all the direct materials that are used to make the specific product and obtain the cost information for the direct materials you have identified. To calculate the cost of direct materials you need to know the cost of inventory.

Examples of Nonmanufacturing Overhead Costs

- For a further discussion of nonmanufacturing costs, see Nonmanufacturing Overhead Costs.

- Manufacturing costs include direct materials, direct labor, and factory overhead.

- As the company decided to assemble the components themselves, they found that the costs of managing the assembly line and the transportation were increasing significantly.

- Costs of production include many of the fixed and variable costs of operating a business.

- The costs of delivery and storage of finished goods are selling costs because they are incurred after production has been completed.

- These minor types of materials, often called supplies or indirect materials, are included in manufacturing overhead, which we define later.

To ensure that you understand how and why product costing is done in manufacturing companies, we use many manufacturing company examples. However, since many of you could have careers in service or merchandising companies, we also use nonmanufacturing examples. Manufacturing cost is the core cost categorization for a manufacturing entity. It encompasses the costs that must be incurred so as to produce marketable inventory. Entities may manufacture several types of products and the sum total of all the costs involved in producing those products is termed as manufacturing cost. Costs that fluctuate based on the level of production or sales, such as raw materials and direct labor.

By calculating manufacturing costs, companies can clearly understand the true cost of making a product. Based on this information, the company’s management can add a markup to determine competitive selling prices for their products. Once you identify the indirect costs, get detailed expense data for each of these overhead cost categories for a specific period, such as a month or a year. You can track expenses by looking at your invoices, receipts, and records of all expenditures related to manufacturing overhead.

Examples of indirect materials (part of manufacturing overhead) include glue, paint, and screws. Direct labor includes the production workers who assemble the boats and test them before they are shipped out. Indirect labor (part of manufacturing overhead) includes the production supervisors who oversee production for several different boats and product lines.

These costs do not specifically contribute to the actual production of goods but are essential to ensure overall functioning of the business. A current asset whose ending balance should report the cost of a merchandiser’s products awaiting to be sold. The inventory of a manufacturer should report the cost of its raw materials, work-in-process, and finished goods. The cost of inventory should include all costs necessary to acquire the items and to get them ready for sale. While depreciation on manufacturing equipment is considered a manufacturing cost, depreciation on the warehouse in which products are held after they are made is considered a period cost. While carrying raw materials and partially completed products is a manufacturing cost, delivering finished products from the warehouse to clients is a period expense.