The average cost is a third accounting method that calculates inventory cost as the total cost of inventory divided by total units purchased. Most businesses use either FIFO or LIFO, and sole proprietors typically use average cost. The first in, first out (FIFO) cost method assumes that the oldest inventory items are sold first, while the last in, first out method (LIFO) states that the newest items are sold first. The inventory valuation method that you choose affects cost of goods sold, sales, and profits.

How do you calculate FIFO and LIFO?

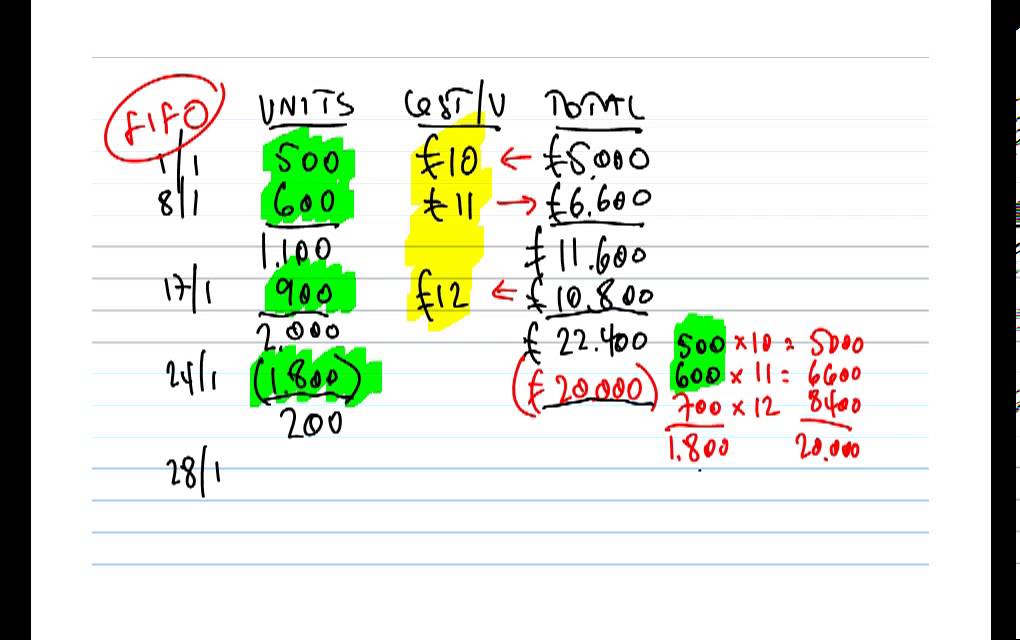

LIFO and FIFO are the two most common techniques used in valuing the cost of goods sold and inventory. More specifically, LIFO is the abbreviation for last-in, first-out, while FIFO means first-in, first-out. The First In, First Out FIFO method is a standard accounting practice that assumes that assets are sold in the same order they’re bought. All companies are required to use the FIFO method to account for inventory in some jurisdictions but FIFO is a popular standard due to its ease and transparency even where it isn’t mandated. Because the FIFO method results in a higher gross profit, it will make the company more attractive to investors.

Best Inventory Management Software of 2024

Your inventory doesn’t expire before it’s sold, and so you could use either the FIFO or LIFO method of inventory valuation. Generally speaking, FIFO is preferable in times of rising prices, so that the costs recorded are low, and income is higher. Contrarily, LIFO is preferable in economic climates when tax rates are high because the costs assigned will be higher and income will be lower.

Improve Inventory Management with FreshBooks

In both cases, only goods actually sold are included in the calculations. This means that if you purchased a batch of 300 goods and only sold 150, you would multiply the purchase price by 150. Finally, FIFO encourages a regular inventory turnover as older stock is sold off first. However, if inventory remains stagnant for a few years, there can be a significant discrepancy between cost of goods sold and market value when sales resume. This means that ‘first in’ inventory has a lower cost value than ‘last in’ inventory.

WAC: Average cost per unit

- For this reason, companies must be especially mindful of the bookkeeping under the LIFO method as once early inventory is booked, it may remain on the books untouched for long periods of time.

- The cost of goods sold for 40 of the items is $10 and the entire first order of 100 units has been fully sold.

- Another advantage is that there’s less wastage when it comes to the deterioration of materials.

- Assume a company purchased 100 items for $10 each and then purchased 100 more items for $15 each.

Let’s say you’ve sold 15 items, and you have 10 new items in stock and 10 older items. You would multiply the first 10 by the cost of your newest goods, and the remaining 5 by the cost of your older items to calculate your Cost of Goods Sold using LIFO. As with FIFO, if the price to acquire the products in inventory fluctuates during the specific time period you are calculating COGS for, that has to be taken into account. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products. In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses.

That only occurs when inflation is a factor, but governments still don’t like it. In addition, there is the risk that the earnings of a company that is being liquidated can be artificially accounting and finance for business inflated by the use of LIFO accounting in previous years. Most companies that use LIFO are those that are forced to maintain a large amount of inventory at all times.

In other words, the older inventory, which was cheaper, would be sold later. In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive. As a result, the company would record lower profits or net income for the period. However, the reduced profit or earnings means the company would benefit from a lower tax liability. FIFO and LIFO are two common methods businesses use to assign value to their inventory.

This results in deflated net income costs in inflationary economies and lower ending balances in inventory compared to FIFO. The inventory item sold is assessed a higher cost of goods sold under LIFO during periods of increasing prices. Each approach detailed above provides a different benefit to any given manufacturer regarding financial reporting, tax obligations, or internal planning. Weighted average costing offers simplistic inventory cost management and is commonly used by many new manufacturers. FIFO offers a company financial reporting that reflects their industry’s current market conditions and is often the choice of a manufacturer dealing with perishable goods. LIFO offers an approach for any manufacturer operating in an inflationary environment looking to minimize their tax liability.

Do you routinely analyze your companies, but don’t look at how they account for their inventory? For many companies, inventory represents a large, if not the largest, portion of their assets. Therefore, it is important that serious investors understand how to assess the inventory line item when comparing companies across industries or in their own portfolios. Although a business’s real income and profits are the same, using FIFO or LIFO will result in different reported net income and profits.

Companies must carefully consider their ability to meet these tax liabilities without compromising operational efficiency or growth initiatives. LIFO, in contrast, tends to produce a higher COGS during inflationary periods, as it matches the most recent, and often higher, costs against current revenues. This leads to lower gross profits and net income, which might not be as attractive to investors. However, the lower net income can be advantageous from a tax perspective, as it reduces the company’s tax burden. This tax-saving aspect can be a strategic advantage for companies operating in highly competitive or low-margin industries.

One of its drawbacks is that it does not correspond to the normal physical flow of most inventories. Also, the LIFO approach tends to understate the value of the closing stock and overstate COGS, which is not accepted by most taxation authorities. If a company uses the LIFO method, it will need to prepare separate calculations, which calls for additional resources. Whether you are a current or prospective client, rest assured that individuals and businesses who choose Fida Accounting LLC receive competent and timely advice.