Fabrizi also talked about the common challenges manufacturers face when calculating the costs of production. In his experience, the most common challenges are a lack of accurate data and the complexity of costing methods. After manufacturing product X, let’s say the company’s ending inventory (inventory left over) is $500. Then, add up the cost of new inventory — this is the cost of raw materials you purchase to manufacture the product. For example, a small business that manufactures widgets may have fixed monthly costs of $800 for its building and $100 for equipment maintenance. These expenses stay the same regardless of the level of production, so per-item costs are reduced if the business makes more widgets.

Production Costs vs. Manufacturing Costs: What’s the Difference?

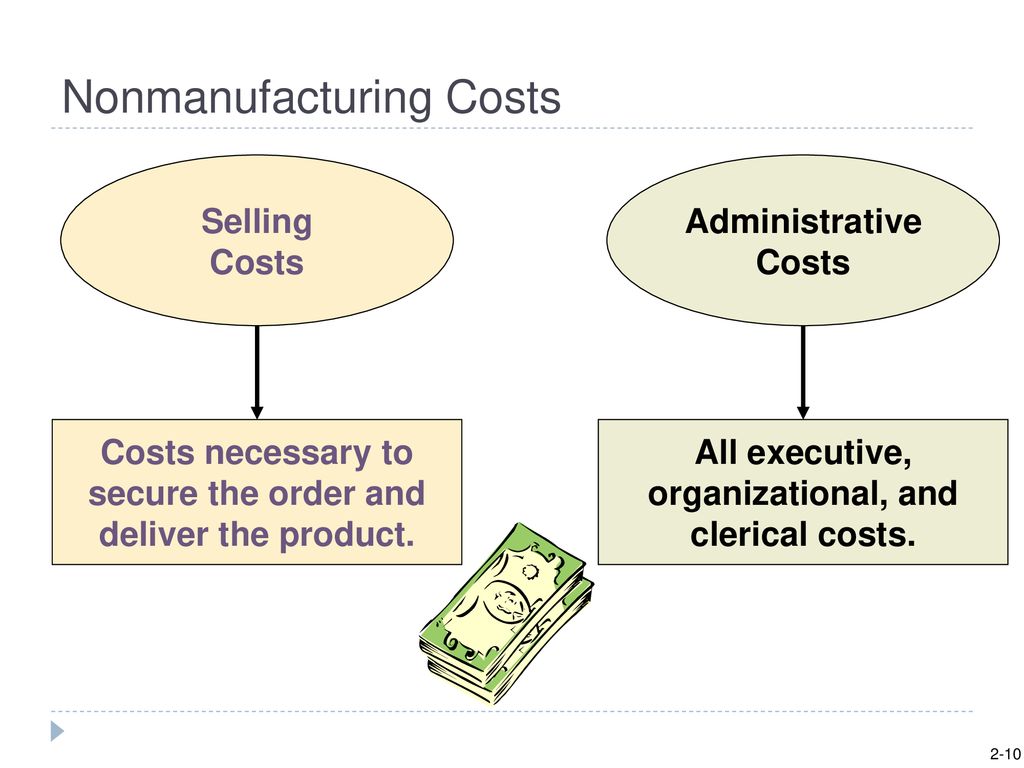

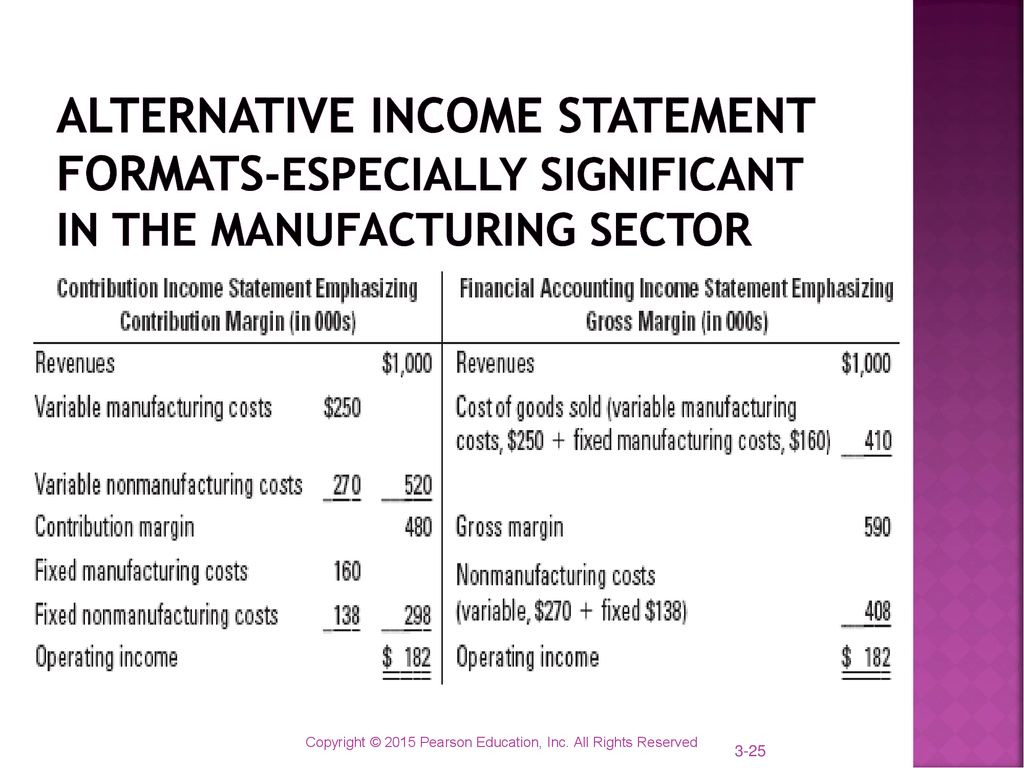

These costs are represented during a period of time and are not calculated into the cost of good sold. Nonmanufacturing costs consist of selling expenses, including marketing and commission expenses and sales salaries and administration expenses, such as office salaries, depreciation and supplies. The purpose of addressing these costs differently as part of a total manufacturing cost formula is based on the fact that they are accounted for differently when structuring the income statement and balance sheet. Manufacturing overhead are costs that are not part of labor or material cost and can be either a fixed or variable cost. For instance, fixed overhead costs consist of property taxes, insurance premiums, depreciation and nonmanufacturing employee salaries, according to Accounting Tools. Whereas, variable direct manufacturing overhead costs include indirect labor, indirect material and utilities.

Cost types included

For example, a clothing manufacturer considers employees that dye the cloth, cut the cloth and sew the cloth into a garment as direct labor costs. However, designers and sales personnel are considered nonmanufacturing labor costs. All these costs – marketing and sales expenses, G&A, and R&D – are non-manufacturing overhead costs. These costs aren’t directly related to the physical production of their devices but are essential to running the business and its long-term growth.

Methods of Allocating Nonmanufacturing Overhead Costs

These indirect costs, also called factory or manufacturing overheads, include costs related to property tax, insurance, maintenance, and other indirect operations that support the production process. Indirect manufacturing costs include all other expenses incurred in manufacturing a product except direct expenses. Recall from other tutorials that variable costs change in proportion to production. For instance, in our example of Friends Company, the company purchases metal parts (raw material) to produce valves. The more valves are produced, the more parts Friends Company has to acquire. Therefore, parts have a variable nature; the amount of raw materials bought and used changes in direct proportion to the amount of valves created.

Manufacturing Overhead (Explanation Part

To produce each widget, the business must purchase supplies at $10 each. After subtracting the manufacturing cost of $10, each widget makes $90 for the business. Costs of production include many of the fixed and variable costs of operating a business. Note “Business in Action 2.3.2” provides examples of nonmanufacturing costs at PepsiCo, Inc. Note 1.48 “Business in Action 1.6” provides examples of nonmanufacturing costs at PepsiCo, Inc.

What Is the Definition of Manufacturing Overhead Budgets?

Manufacturing businesses calculate their overall expenses in terms of the cost of production per item. That number is, of course, critical to setting the wholesale price of the item. Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables. In fact, you budget report definition, example how it works already know that labor costs can spiral out of control if you don’t meticulously monitor them. Manufacturers can compare the costs of making a product using different manufacturing processes. This helps them understand the most efficient process and the investment they need to make for the selected process.

Examples of general and administrative costs include salaries and bonuses of top executives and the costs of administrative departments, including personnel, accounting, legal, and information technology. The two broad categories of costs are manufacturing costs and nonmanufacturing costs. As the manufacturing process involves raw materials and finished goods, all of these are considered assets. The materials that are yet to be assembled /processed and sold are considered work-in-process or work-in-progress (WIP) inventory.

Therefore, the per-item cost of manufacturing falls and the business becomes more profitable. Both of these figures are used to evaluate the total expenses of operating a manufacturing business. The revenue that a company generates must exceed the total expense before it achieves profitability. Note “Business in Action 2.3.1” details the materials, labor, and manufacturing overhead at a company that has been producing boats since 1968.

- Since they are not allocated to goods produced, these costs never appear in the cost of inventory on a firm’s balance sheet.

- Though most of these costs are self-evident, indirect material costs are unique because these costs are not essential to the physical production of the product.

- Table 2.3.1 provides several examples of manufacturing costs at Custom Furniture Company by category.

- When inventory items are acquired or produced at varying costs, the company will need to make an assumption on how to flow the changing costs.

- In his experience, the most common challenges are a lack of accurate data and the complexity of costing methods.

That’s why you need a reliable partner to buddy up with and slash your costs. In case you’re spending too many resources on a task or project, the option to set budgets in Clockify will give you a detailed insight into how you can better balance those resources. If the net realizable value of the inventory is less than the actual cost of the inventory, it is often necessary to reduce the inventory amount. A word used by accountants to communicate that an expense has occurred and needs to be recognized on the income statement even though no payment was made. The second part of the necessary entry will be a credit to a liability account.